Where we get our money

By Steve Varnum

People are often surprised to learn that most of the money we use to provide loans and education comes from individual investors and donors, not the government.

“Where do you get your money?”

It’s a question we’re asked nearly every time we introduce people to our work, and they’re almost always surprised by the answer.

Neighbors helping neighbors is one of our guiding principles. Many neighbors who support our work by investing or donating their money are individuals. Foundations, banks, and other nonprofit organizations also pitch in to help their New Hampshire neighbors help themselves.

A common assumption is that organizations like ours get a lot of funding from federal and/or state governments. In fact, we rely mainly on private investors and donors.

One way to understand where we get our money is by looking at how it’s used.

Used for: Money we lend

Investments and permanent capital

We are a nonprofit revolving loan fund and have loaned nearly $270 million into N.H.’s communities, $17.6 million in fiscal year 2017 alone.

We are a nonprofit revolving loan fund and have loaned nearly $270 million into N.H.’s communities, $17.6 million in fiscal year 2017 alone.

Most of the money we lend comes to us through our Opportunity NH Investments. These are real, interest-paying, investments, much like a person would make in a CD, bond, or in a mutual fund, but with two important differences: They earn fixed-rate interest—rates don’t fluctuate with Wall Street—and every dollar is put to work right here in N.H.

More than three-quarters of our investors are individuals, and they’re almost the largest investor group by dollar amount too. Banks have invested just a little more.

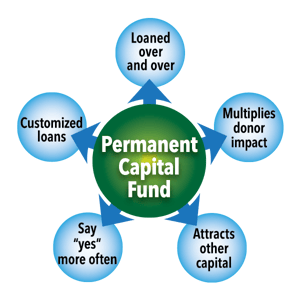

Our Permanent Fund comprises the rest of the money in our revolving loan pool. This is money that has been donated or granted to us, and that we don’t need to repay.

The Permanent Fund is super-important to what we do because, unlike investments, which are repaid with interest at a certain time, using our own money allows us to be as flexible as possible to help our borrowers. For instance, we can use it to offer special terms for down payment and closing cost assistance to low-income homebuyers.

Used for: Education, training, and technical assistance for borrowers

Donations and grants

There’s a reason most lending institutions can’t lend to the people and communities we do. Low- and moderate-income people, and many of the businesses that hire them and the community organizations (including child care) that serve them, don’t have a lot of assets. Mainstream lenders interpret a lack of assets as risk, as in, if the borrower’s plans don’t work out, they have no other way to repay.

We can’t afford not to be repaid either, because we lend our investors’ money.

We increase our borrowers’ likelihood of success by offering and/or providing training or technical assistance. Every opportunity requires some “know how.” Whether it’s credit coaching for a family struggling to buy an affordable manufactured (mobile) home, a “boot camp” training for the directors of a new resident-owned community, business training for child care directors, or consultants matched to the needs of a growing business, training is the “special sauce” that helps our borrowers reach their goals.

Donations to the Community Loan Fund pay for that training, as do grants from sources like foundations and banks.

Used for: Salaries, offices and other business costs

Earnings

Routine costs, like office space, utilities, mileage, and salaries and health benefits for our staff, are covered primarily from the earnings on our lending.

***

Hopefully, this answers where we get our money and how it is used. If you still have questions, please leave them in a comment, and we’ll respond asap.

Steve Varnum is the Community Loan Fund's Communication Director.