We lend, and we learn. Celebrating 20 years of Welcome Home Loans

By Kathi Paradis

It has been 20 years since New Hampshire Community Loan Fund created the nation’s first fair, fixed-rate, mortgage loans for manufactured homes.

Of course, we’ve helped people with low and moderate incomes stabilize and improve their financial lives for much longer. But the inability of manufactured home buyers to get affordable home loans was not a problem we recognized on day one.

It’s one of many lessons we’ve learned in our nearly 40 years of providing loans and technical assistance to help traditionally underserved people achieve housing, create jobs, and have access to community services.

In 1984, when we began helping groups of residents buy their manufactured-home parks, we hoped their ability to keep lot rents (what homeowners pay for the use of the land their house sits on) affordable would translate into financial security.

In 1984, when we began helping groups of residents buy their manufactured-home parks, we hoped their ability to keep lot rents (what homeowners pay for the use of the land their house sits on) affordable would translate into financial security.

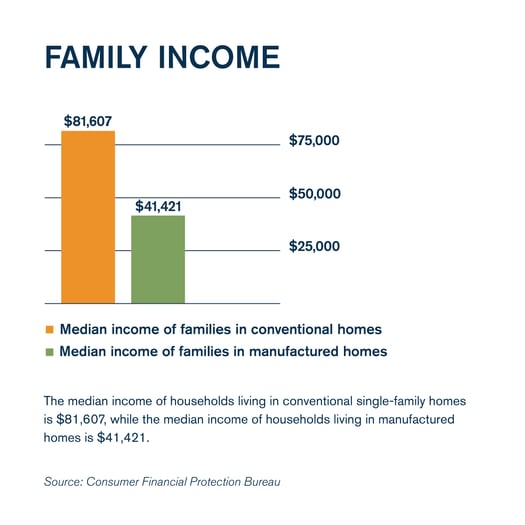

That was true for some homeowners in the resident-owned communities (ROCs), but not most. Because they couldn’t get conventional mortgage loans when buying manufactured homes, many financed their houses like they would a car. At a time when the average mortgage interest rate was less than 7%, they were paying double figures, sometimes as high as 16%, to buy homes.

Said a Raymond homeowner of their 14% loan, “That’s the best I could do. We either had to take that or we could not take the home.”

Lois Parris, then leader of the Manufactured Home Owners and Tenants Association (MOTA) of New Hampshire, was determined to keep manufactured home owners’ lending needs on the radar of Community Loan Fund President Juliana Eades.

“Lois’s persistence and impatience kept it on our plate,” Julie said. “Every time I talked to her she said, ‘Finance the homes. Finance the homes.’ ”

So, we did. In January, 2003, with backing from five banks and the New Hampshire Community Development Finance Authority, we created the nation’s first fair, fixed-rate, mortgage loans for manufactured homes in cooperatively owned parks. They became known as Welcome Home Loans.

Twenty years later, we’ve made 1,579 Welcome Home Loans totaling more than $87 million. Every one of those households either bought a home or refinanced their existing loan for better terms.

Twenty years later, we’ve made 1,579 Welcome Home Loans totaling more than $87 million. Every one of those households either bought a home or refinanced their existing loan for better terms.

Those successful loans, and N.H.’s affordable housing needs, encouraged us to go deeper. A decade later we began financing manufactured homes on their own land.

We were also seeing hopeful buyers who could afford a monthly mortgage payment but didn’t have the savings to cover a down payment and closing costs. So we created a loan program to help those who don’t have the savings to buy their own home.

Our Welcome Home Loans have never been as relevant, and as important, as they are today, when so many working people, veterans, and retirees in New Hampshire not only can’t afford to buy homes, they can’t even afford to rent apartments.

We lend, and we learn. The next 20 years are sure to bring more innovations drawn from our experience and driven by the housing needs of the Granite State’s people and families.

Kathi Paradis is the Community Loan Fund's VP of Residential Lending & Compliance.