Manufactured housing: Naturally affordable

By Community Loan Fund staff

Cathy Bailey financed her "perfect home" with credit cards before she discovered Welcome Home Loans, refinanced, and saved $287 a month.

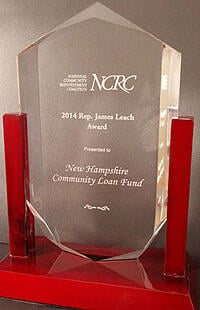

It was a true honor to attend the National Community Reinvestment Coalition's annual meeting recently in Washington, D.C. The NCRC presented the New Hampshire Community Loan Fund with its Rep. James Leach Award in honor of our pioneering resident-owned manufactured-home communities and Welcome Home Loans.

Watch the video of the presentration.

The Leach Award recognizes the most outstanding rural nonprofit organization that best promotes fair and equal access to credit and capital and promotes wealth-building in traditionally underserved populations.

The Community Loan Fund focuses on manufactured homes because they are so affordable. The average sale price is $44,000. Most renters pay more each month than their mortgage payment would be for a manufactured home.

The Community Loan Fund focuses on manufactured homes because they are so affordable. The average sale price is $44,000. Most renters pay more each month than their mortgage payment would be for a manufactured home.

Manufactured homes make up a sizable part of New Hampshire's housing stock. N.H. has 36,000 manufactured homes; about half are in investor-owned parks and resident-owned communities. Manufactured homes comprise 6% of all homes in the state and most of the affordable homes under $100,000.

Not everyone needs or wants a $245,000 home, which is the median home value in N.H. now. Manufactured homes are naturally affordable because of their modest size and because they're efficiently built in factories.

Lack of access to credit

Yet manufactured-home owners still face significant, unique disadvantages.

Few mainstream lenders offer financing for manufactured homes, so buyers use credit cards or high-interest-rate personal loans. Most lenders require a 20% down payment and excellent credit, which eliminate most low- and moderate-income buyers. Most lenders won't finance older manufactured homes and homes placed on certain foundation types, even if the homes have been well-maintained. All in all, lack of access to credit hurts people's ability to buy or sell manufactured homes, and ultimately hurts these homes' asset values.

What makes our Welcome Home Loans different is that they are real mortgage loans long-term, fixed-rate, stable financing for manufactured homes of all ages. We believe that regular access to fair mortgage financing can help maintain, or increase, the value of homes located in resident-owned communities and on their own land.

What makes our Welcome Home Loans different is that they are real mortgage loans long-term, fixed-rate, stable financing for manufactured homes of all ages. We believe that regular access to fair mortgage financing can help maintain, or increase, the value of homes located in resident-owned communities and on their own land.

We also help homeowners refinance their homes, replacing predatory products with loans featuring longer terms and lower monthly costs.

Low down payment helps low-income borrowers

We will also lend more of a home's value, meaning a borrower can make a lower down payment. Many low- and moderate-income buyers who can afford mortgage payments struggle to come up with 20% down. And private mortgage insurance, which could lower the down payment, is typically not available for manufactured homes. So our low-down-payment loans remove the down-payment barrier to homeownership.

And it turns out that these are very good borrowers. A national report from CFED supports what we have long believed: Manufactured-home loans can perform as well as, or better than, site-built homes. We've been making these loans for 12 years, which includes a five-year recession, and have been repaid 98.12% of the time.

We recently made our 800th Welcome Home Loan. We are proud of every one of those families, most of them first-time homeowners who otherwise would not have access to real mortgages for their manufactured homes. They worked hard to buy their homes, and we're thrilled that NCRC, in honoring Welcome Home Loans, honored them.

New Hampshire Community Loan Fund Inc. NMLS ID 253893. Licensed by the New Hampshire Banking Department.